Buying a drone is exciting but have you ever thought about what happens if it crashes, gets stolen, or accidentally causes damage? Whether you’re a content creator flying over a wedding venue or a business using drones for mapping or surveillance, drone insurance is one topic you shouldn’t ignore.

As drone usage continues to grow across India in fields like agriculture, filmmaking, infrastructure, and delivery logistics, so do the risks both financial and legal. While most drone buyers focus on features like camera resolution or flight time, understanding drone insurance is just as important to protect your investment.

In this guide, we’ll break down what drone insurance is, who needs it, what it covers, how much it typically costs in India, and how to choose the right policy based on your use case.

Whether you’re a beginner or a business buyer, this blog will help you make an informed, risk-free decision.

Whether you’re a hobbyist, a business owner, or an enterprise client buying from sellers like Jetayu Gadgets, this guide will help you protect your investment and stay compliant with evolving drone laws.

Why Drone Insurance Matters in India

For many drone buyers, the excitement of capturing stunning aerial views or automating a business process often overshadows the risk involved. But once that drone lifts off the ground, you’re not just flying a gadget you’re responsible for a flying asset that could crash, malfunction, or cause unintended damage.

1. Accidents Happen Even with Safety Features

Despite modern drones like the DJI Mini 3 and DJI Mini 4 Pro boasting collision avoidance sensors and return-to-home systems, accidents still occur due to weather, user error, or technical glitches. Even beginner-friendly models with DJI’s Fly More Combo don’t make you immune to risks like:

- Flyaways and loss of control

- Hard landings and water crashes

- Mid-air collisions with birds, trees, or buildings

Worried about crashing your first drone? Here’s why DJI’s safety features have your back.

2. Drone Repairs Are Expensive

Even a minor impact can damage the gimbal or propellers. Full-frame repairs can cost thousands especially for camera drones used by YouTubers, vloggers, or commercial surveyors. If you’ve invested in a premium model or bought accessories separately, insurance can protect your wallet from these unexpected hits.

Thinking of upgrading instead of repairing? Sell your old drone with just a few clicks.

3. You Might Be Legally Liable

Imagine your drone injures someone, damages property, or causes a road accident. In such cases, liability insurance becomes critical, especially for drones used in:

- Construction or infrastructure projects

- Public events and wedding shoots

- Agriculture and industrial mapping

4. Businesses and Professionals Must Comply with DGCA Norms

If you’re buying a drone for commercial purposes whether it’s agriculture, logistics, or surveillance you may need insurance as part of regulatory compliance. Some enterprise drone buyers already consider it mandatory for:

- Tenders and contracts

- Project certifications

- Cross-border drone logistics

Read more: Can I fly my drone freely or do I need a license?

5. Protecting Public Safety

As more drones enter Indian skies, incidents of privacy violations, airspace breaches, and property damage are growing. Insurance helps:

- Build trust with clients or event hosts

- Offer recourse in case of public complaints

- Minimize legal complications

This is especially important for drone pilots working near sensitive locations or in regulated zones.

Types of Drone Insurance Available in India

Drone insurance isn’t one-size-fits-all. Whether you’re a solo content creator, a wedding videographer, or a business running a fleet for industrial purposes, the type of insurance you need will vary. Here’s a breakdown of the most common options available in India:

1. Hull Insurance (Physical Damage Coverage)

This covers accidental damage to the drone itself, including:

- Crashes during flight

- Damage during landing or takeoff

- Weather-related damage

- Water or fire damage

It’s ideal for buyers who’ve invested in premium models like the DJI Mavic 3 Enterprise or Autel EVO II, where repair costs can be significant.

Also relevant: From cracked to crafty: Repair your drone, fly like it’s day one.

2. Liability Insurance

Covers third-party claims if your drone:

- Injures someone

- Damages property

- Causes business interruption

This is critical for commercial drone users like:

- Builders conducting site surveys

(See: Why builders now trust drones more than ground teams) - Police or security teams using surveillance drones

(See: Gujarat Police cleared to launch high-tech drone program)

3. Theft & Loss Coverage

This includes protection if your drone is:

- Stolen from storage or during transport

- Lost in flight and not recoverable

- Vandalized

Ideal for:

- Vloggers shooting in remote areas

(See: Vlogging your solo adventure? Here’s what only a drone can film)

4. Payload Insurance

This covers high-value equipment like:

- Camera rigs

- Thermal sensors

- Multispectral units

Essential for drones used in:

- Forest monitoring or disaster management

(See: Drones could be heroes in the Northeast’s flood crisis)

5. Fleet or Enterprise Drone Insurance

For companies operating multiple drones, insurers offer:

- Bulk policies with lower per-unit premiums

- Custom coverage depending on usage type

- Add-on employee training protection

Relevant for:

- Agri-tech startups

(See: How agri-tech companies are transforming Indian farming) - Content agencies or drone rental services

(See: Why more creators and surveyors are renting drones)

Is Drone Insurance Mandatory in India? Rules You Should Know

One of the most common questions drone buyers ask is:

“Am I legally required to get insurance for my drone in India?”

The short answer: Not always but it depends on the purpose, weight category, and flight location.

Here’s a simplified look at the legal framework.

1. DGCA Guidelines on Drone Insurance

As of 2025, India’s Directorate General of Civil Aviation (DGCA) does not make insurance mandatory for personal or recreational drone use. However, it does strongly recommend it, especially when:

- Flying near populated areas

- Using expensive drones

- Flying drones over property or people

But if you’re using your drone for commercial activities, such as:

- Surveying farmland

- Shooting weddings or branded content

- Conducting infrastructure inspections

You’ll likely need third-party liability insurance as part of your compliance.

Also read: Can I fly my drone freely or do I need a license?

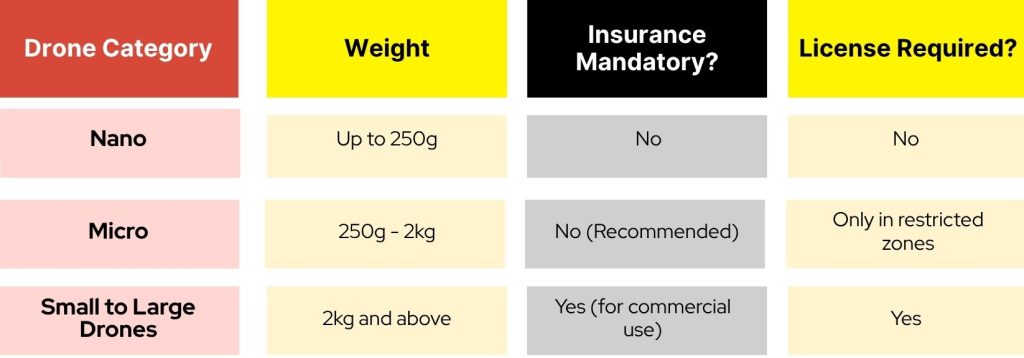

2. Weight Category Plays a Role

The rules and risk level vary by drone weight. Here’s a quick summary:

More context: Why your drone’s weight decides what rules you follow

If you’re flying a lightweight drone like the DJI Mini 4 Pro, you may not need insurance legally, but it’s still wise especially if you fly around people or in tight urban spaces.

3. Common Misconceptions

Let’s clear a few misunderstandings:

- “My drone is small, so it doesn’t need insurance.”

False. Even lightweight drones can cause injuries or be lost during flight. - “Insurance only matters for commercial users.”

Not true. Hobbyists often operate near homes, roads, or gatherings where damage is possible. - “The manufacturer covers all damage.”

Not entirely. Warranties don’t cover accidental crashes or third-party damages.

Pro tip: Bought a drone recently? Here’s how to verify if it’s not refurbished.

What Does Drone Insurance Typically Cover? (And What It Doesn’t)

Before you invest in a policy, it’s important to know what protection you’re actually getting. Drone insurance plans in India often differ based on the provider, but most follow a few standard inclusions and exclusions.

Here’s a clear breakdown:

What Drone Insurance Usually Covers

Accidental Damage

From crash landings to mid-air collisions, most plans cover:

- Broken propellers

- Damaged camera/gimbal

- Cracked body or landing gear

Theft or Loss

If your drone is stolen or goes missing during a flight and cannot be recovered (with proof like GPS logs), many policies will reimburse you based on market value.

Liability to Third Parties

Covers legal or financial responsibility if your drone:

- Injures someone

- Damages a vehicle, building, or crops

- Interrupts a commercial operation

Payload and Accessories (Optional Add-on)

Some insurers let you add coverage for:

- Gimbals, cameras, multispectral sensors

- Additional batteries and controllers

- Accessories like propeller guards or ND filters

Natural Disasters (Selective)

Certain comprehensive policies may include fire, floods, or lightning damage, especially relevant in areas prone to floods, cyclones, or landslides.

Relevant read: Drones could be heroes in the Northeast’s flood and landslide crisis.

What’s Usually Not Covered

Pilot Negligence

If you knowingly fly during bad weather or in restricted airspace without permission, claims may be rejected.

Unauthorized Flight Zones

Flying near airports, military zones, or government buildings without clearance can void your coverage.

Wear and Tear

Gradual damage like battery degradation, motor wear, or propeller dullness isn’t covered.

Intentional Damage

If damage is caused on purpose or during an unapproved modification attempt, the policy won’t apply.

Flying Without DGCA Approval (For Commercial Use)

If you’re operating a drone commercially but haven’t registered it or obtained the required permissions, your insurer may not honor claims.

How to Avoid Rejected Claims

To stay protected, make sure you:

- Register your drone with DGCA (if required)

- Keep logs of flights and incidents

- Use only approved accessories

- Avoid flying in restricted zones

Also helpful: How to get a commercial drone license in India in 2025.

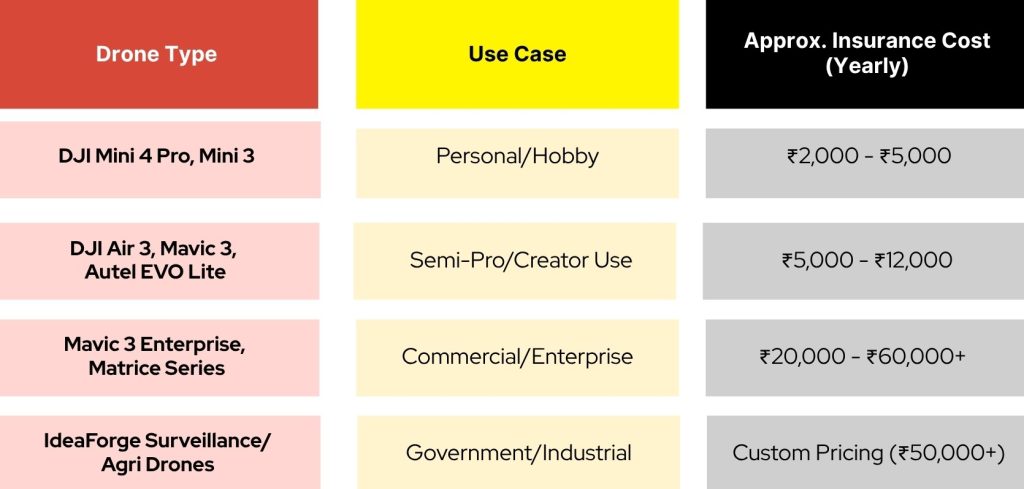

How Much Does Drone Insurance Cost in India? A Quick Price Breakdown

Drone insurance costs in India can vary depending on several factors like drone type, usage (personal vs. commercial), and the extent of coverage. Whether you’re flying a lightweight hobby drone or a high-end enterprise model, understanding the cost components will help you budget smartly.

Average Drone Insurance Costs in 2025

Here’s a quick overview of typical pricing brackets:

Note: These are average market rates. Pricing may vary depending on provider, drone value, and additional payloads.

Factors That Influence the Cost

- Drone Value

Higher-value drones like the Matrice 30 or Mavic 3 Enterprise cost more to insure due to their replacement price and advanced tech. - Type of Coverage

- Basic hull insurance is cheaper

- Adding liability, theft, or payload insurance increases the premium

- Use Case

- Recreational users pay less

- Commercial operators (construction, mapping, law enforcement) pay more due to risk exposure

- Flight Frequency & Risk Area

Flying in high-risk zones (urban, forest, disaster zones) or frequent flying increases the premium

Use case tip: Thinking of buying a commercial drone? Here’s what you need to know first.

Are There Monthly Plans or Only Annual?

Most insurers in India offer annual policies, but some providers are beginning to roll out monthly and short-term policies especially for:

- One-time events

- Seasonal farming

- Short-term content shoots

Example: A YouTuber vlogging in the Himalayas might prefer temporary coverage.

Touch the sky. Capture your India from the Himalayas to the Sea with your drone.

If you’re working with a limited budget, explore options like:

- Pay-per-use insurance

- Bundle insurance with financing plans

Resource: Can’t pay full price? Here’s how to finance a drone smartly in 2025.

FAQs About Drone Insurance in India

1. Is drone insurance mandatory for all drone users in India?

No. Drone insurance is not mandatory for recreational users flying nano or micro drones (under 2kg) in unrestricted zones. However, for commercial use or larger drones, third-party liability insurance is highly recommended and sometimes required for regulatory or contractual compliance.

2. Does drone insurance cover crashes due to pilot error?

Yes, most hull insurance plans cover accidental damage caused by pilot error, including crashes. However, if the crash occurred due to reckless flying, ignoring weather warnings, or operating in restricted zones, the claim may be denied.

3. Can I get insurance for a refurbished drone?

Some insurers do cover refurbished drones, but the terms may be stricter. You’ll typically need:

- Proof of purchase

- Serial number verification

- Inspection reports (in some cases)

Resource: Bought a drone recently? Here’s how to verify if it’s not refurbished.

4. How long does it take to get a drone insurance policy approved?

For personal drones, approval can take as little as 24–48 hours if documentation is complete. For commercial drones or fleet insurance, it may take up to 7 working days, especially if custom risk assessments are required.

5. Will insurance cover damage to accessories like extra batteries or propeller guards?

Only if you opt for accessory or payload add-on coverage. Basic plans usually don’t cover accessories unless bundled. It’s best to confirm the inclusions and exclusions before finalizing your policy.